Better Portfolios mean Better Performance

Welcome to Optimal Portfolio Strategies (OPS). We design, build and maintain investment strategies that are licensed to asset owners, investment institutions and retail investors.

Inhouse OPS strategies can be adapted to suit your particular requirements. OPS also builds custom strategies incorporating your own alpha signals, and tailored to suit your own investment preferences.

All OPS strategies are suitable for direct indexing and tax loss harvesting.

Why Choose an OPS Strategy?

Different portfolios can all hold the same stocks, but they will all have different performance. This shows clearly that portfolio construction matters to performance.

Many fund managers have stock selection skills, but few manage to outperform their benchmarks, mainly because their portfolios don’t efficiently capture their skill.

The OPS portfolio rebalancing algorithm maximises the impact of stock selection skill on portfolio performance, while minimising the impact of uncompensated risks. The performance of an OPS portfolio is therefore an accurate reflection of the stock selection skill, and is not dominated by unintended bets, unlike common heuristic methods of portfolio construction, which always leave some potential outperformance on the table.

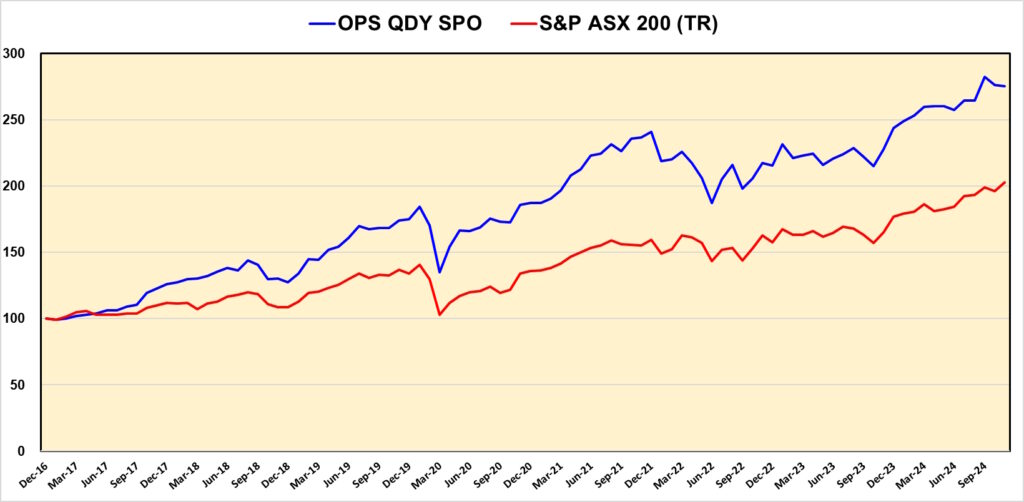

OPS Australian Quality Dividend Yield Strategy

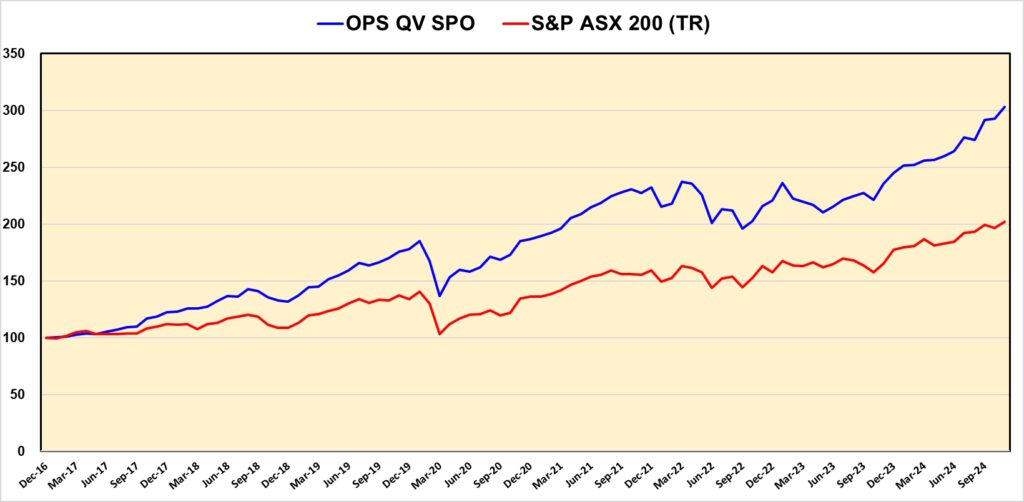

OPS Australian Quality & Value Strategy

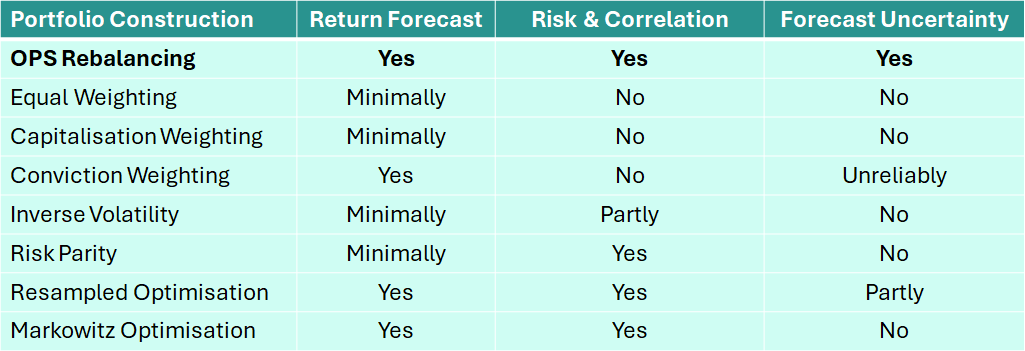

The Table below shows that OPS Rebalancing takes into account not only the Expected Returns and Risks of the individual stocks, but also the uncertainty in the forecasts. It is the only portfolio rebalancing method that does this.